A DGRV Kenya’s new initiative!

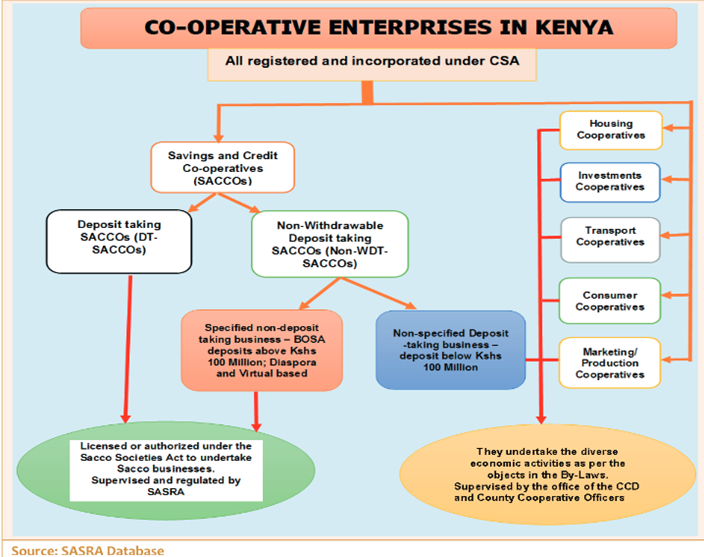

Co-operatives supervision in Kenya, aimed at protecting the interest of the members, is conducted by different Government organizations as shown here:

Whereas SACCO Societies Regulatory Authority (SASRA) regulates 175-Deposit Taking SACCOs and 185 Non-Withdrawable-Deposit Taking SACCOS whose deposits per each are KES 100 million and above (SASRA SACCO Supervision Report, 2022), the more than 4000 Non-Withdrawable-Deposit Taking SACCOS ( Small SACCOS) with deposits below KES 100 million are regulated by the Commissioner for Co-operative Development and counties’ co-operative officers.

To strengthen the supervision of these “small SACCOS”, DGRV Kenya is scaling up the rolling out of its “Risk-Based Standard Supervision Framework for Non-Withdrawable Deposit Taking SACCOs” it had developed sometimes back, in collaboration with the Directorate of Cooperative Development, County Government of Narok”, to the County Governments of Kajiado and Nyeri. The Framework is a composition of standard supervision guidelines and digitized tools to be used by co-operative auditors, supervisory committees, and co-operative officers when performing the respective supervision function.

Our current upscale focus as a Project are the standard supervision guidelines and digitized tools for use by the co-operative officers. It is envisaged that, once the standard supervision guidelines and digitized tools are fully implemented, the co-operative officers will be able to identify early, in their respective counties, the “red flags” in the “small SACCOS with financial distress” for technical support. This will not only improve the protection of the members ‘deposits, but it will inculcate confidence and trust in the SACCOS sub-sector for exponential growth. In addition, the co-operative officers will be able to have “real-time” helicopter view of the status of the SACCOS in terms of the performance of the loan and savings books.